It’s bad news on the van insurance front, with premiums expected to rise by almost 30% year-on-year as new compensation rules and tax increases come into effect.

The prediction comes from research consultants Consumer Intelligence, which says prices have soared this year after regulators reduced the discount governing payouts in major personal injury claims (known as the ‘Ogden rate’) to -0.75% from 2.5% in March, meaning insurance firms have to pay more in compensation.

John Blevins, pricing expert at Consumer Intelligence, says that this, along with tax rises and claim costs, are adding to the pressure. “Before the Ogden rules came into effect in March, prices were rising by around 1% a month and then rocketed by 11.4% in April, with the Insurance Premium Tax rise in June [up from 10% to 12%] adding another 2%,” he tells What Van?

Caroline Hurst from fleet management and software company Lytx warns that with small fleets an entire business can be wiped out with one severe collision. “Premiums can become prohibitively expensive, making the cost of doing business untenable,” she explains, adding: “Larger fleets are likely to be self-insured, which means every collision claim comes off the bottom line. Those that are insured through a third party can see premiums skyrocket if the fleet has a bad year with multiple catastrophic collisions.”

How to reduce policy costs

To counter accelerating premiums businesses will have to look to implement some cost-reduction policies.

Blevins explains that the first step is choosing the correct cover. Opting for ‘carriage of own goods’ not only ensures you have the correct cover in the event of having to make a claim, but also, he says, will mean reduced premiums. That’s due to insurers rating customers who use vans for work as a better risk – compared with those who, for example, tick the ‘social, domestic and pleasure’ box – because they are more likely to be careful with their vehicle as it’s vital for their livelihoods.

Shopping around is also sensible, Blevins advises, “as prices vary month by month and between providers”.

He adds that as most general insurers operate on a non-advised basis – essentially, they offer their cover options to the customer and the customer decides what best suits their own needs – businesses should consider cover levels in terms of the maximum amounts different insurers will pay out as each firm “will know through experience how much their tools or goods carried are worth”.

“One area where they can look to keep their premiums down is in the vehicle they choose to purchase,” says Blevins. “The insurance group of the vehicle will be an important factor. Ways to keep the grouping down is by choosing a lower engine-size vehicle – the higher the engine capacity generally means the higher the group. For example, 1,600cc will be a lower group than 2,000cc.”

The performance of a vehicle is also a factor: the faster it can go the more likely it is to be in an accident, so the higher the grouping, Blevins says.

Weight, he continues, is also an indicator for grouping: the heavier a vehicle, the more difficult it is to drive, again leading to higher grouping.

If you don’t have one already, it’s worth considering fleet insurance over individual policies, as Blevins explains: “Your fleet policy would generally be cheaper than individual policies, given you are effectively buying in bulk.” There’s also the added benefit that all vehicles are covered under a single policy offering them all the same level of cover and a single renewal date.

Despite these suggestions, Blevins is not convinced that anything can compensate fully for the rate at which insurance prices are rising. “These are all worth a shot and may sound optimistic,” he says, “but, unfortunately, it seems the only way is up.”

Furthermore, there are many other factors that contribute to pricing van insurance and which cannot be altered – for example, the driver’s age, where they live, claims and conviction details, and occupation.

Blevins also argues that in terms of policy cover there is little difference between the owner and drivers. “The same cover is generally provided for all named drivers whether you are the registered owner or a named driver. The ‘driving other vehicles’ policy extension is only for the policyholder, but other cover remains the same overall,” he explains.

Lytx claims DriveCam can cut collisions-related claims costs by up to 80%

Lightfoot’s green, amber and red lights encourage safer driving

One way to keep insurance premiums down is by attempting to improve an employee’s driving style. Devices such as Lightfoot, for example, can guide drivers to a smoother, safer style, resulting in fewer accidents.

Used in over 10,000 vans across the UK, Lightfoot claims that a smoother driving style significantly reduces accident levels in fleets.

Jonathan Dye, head of motor insurance at Allianz, tells WhatVan?: “We are committed to using new technologies that help our customers improve driver safety while reducing their operating costs. Running a safe and cost-effective fleet is crucial to maintaining a profitable business, which is why more and more companies are investing in risk management initiatives, such as Lightfoot, to help manage their fleets.”

Lightfoot’s small dashboard device provides visual and audible nudges that swiftly guide users to adopt a more careful driving style. Lightfoot offers incentive rewards to drivers achieving ‘Elite Driver’ status. This positive reinforcement, enabled by Lightfoot’s real-time in-cab feedback, means fewer instances of harsh acceleration, braking and the higher-risk driving habits associated with accidents. “The outcome is a reduction in accidents by up to 60% among fleets using Lightfoot,” claims Dye.

Mark Roberts, managing director of Lightfoot, explains: “Lightfoot is a long-term risk management solution that enables drivers to adopt a smoother, safer driving style and then rewards them personally for doing so. A proven result of this is a significant reduction in claims frequency (up to 40%) and a resulting reduction in claims value of up to 60%.”

Roberts continues: “There is no silver bullet for reducing insurance premiums. However, motivating your drivers to be safer – resulting in fewer claims and reducing overall cost of claims – can only have a positive effect on a client’s overall insurance-related costs within their fleet.”

Dashcams and security

To offset hefty insurance costs, some fleets are looking to different types of solutions, such as dashcams.

“There are a few insurers out there who ask if you have a dashcam fitted and in turn offer a small discount,” says Blevins. “This is due to the fact that evidence could be produced to show claims circumstances, and so questions over liability could be answered definitively, so helping keep costs down for insurers in terms of claim payouts. They would also help identify fraudulent cases.”

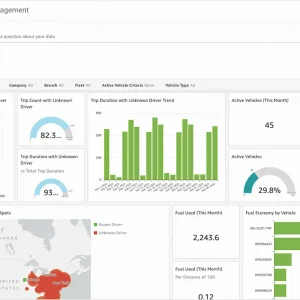

Lytx offers a dashcam called DriveCam, which Hurst says can reduce collision frequency by up to 50%, and reduce collisions-related claims costs by up to 80%. As well as capturing video footage of a driving event, like a hard brake or a sudden swerve, Hurst says DriveCam helps Lytx to deliver precise and personalised coaching insights along with the video clips, aiding drivers in improving their approach to safety and preventing collisions before they happen. “In the event collisions are unavoidable,” Hurst says, “the DriveCam video helps exonerate drivers, especially when it’s their word against another driver’s.”

Also, fleets quite often experience ‘mystery damage’ in the yard, where vehicles suffer dings and scrapes, seemingly out of nowhere, says Hurst. “The DriveCam event recorder is triggered by impact, even if the vehicle is stationary, and can capture those ‘mystery damage’ events to help identify the responsible party.”

Figures obtained by the BBC from 30 police forces show that thefts from vans have increased from 14,063 in 2014/15 to 22,749 in 2016/17, meaning that a van is broken into every 23 minutes.

With numbers such as those, perhaps it’s no surprise that insurers tend to offer small discounts for effective security measures, while Blevins from Consumer Intelligence says fitting Thatcham 1-approved alarms and immobilisers where not standard could help reduce premiums,

Simon Cook, LCV manager at vehicle leasing Arval, says the BBC figures are consistent with what he is hearing from fleets at the moment: “In our experience, van crime tends to occur in cycles and our feeling is that we are on an upswing.?What tends to happen is that thieves devise a new method of breaking into a van, operators adopt ways of preventing it, and there follows a decrease in the crime. Then, new techniques start to appear, and the whole thing happens again.”?

While Arval also acknowledges that there isn’t a single perfect solution to avoid being the victim of crime, it says it is possible to mitigate the risk of theft by fitting the right security equipment such as slam locks and trackers. “Look at which will be the best way to protect your van and make it difficult, noisy, or time-consuming for thieves to get in,” concludes Cook.