Volkswagen endured a bruising final quarter to 2015 when the emissions rigging scandal knocked back the brand and overshadowed the launch of two of its crucial LCVs, the Caddy and the Transporter.

Nevertheless, the commercial vehicle division did manage to grow sales by 8% to 47,739, giving it an 11.6% market share, to hang on to its second-top spot in the market and lead UK boss Carl zu Dhona to describe last year as an “absolute record”.

Caddy sales dipped from 14,338 to 13,353 as the brand moved to switch the supply from Euro5 versions, which were caught up in the emissions saga, to Euro6 derivatives, of which there was a shortfall. At the same time VW lowered Euro6 model prices to match those of the withdrawn Euro5 vans.

Transporter volume increased from 20,509 to 22,062 with the T6 launched in September, but its share of the medium van sector fell from 19% to 16.5%.

Sales of the large Crafter van reached 8027, the first time they have exceeded 8000 in the UK and sales of the Amarok pick-up grew to 3889 from 3109, with supply now matching demand, according to VW.

All in all a total of 76,000 LCVs have been affected by the emissions scandal in the UK, consisting of 1.6-litre Euro5 Caddy vans and 2000 Amarok pick-ups.

Volkswagen says the fixes for both the Caddys, which require a software update and the fitting of an airflow transformer, and the Amaroks will begin in September.

With the damage to its reputation and with the brand also shifting 13,223 used vans through its network last year – a figure it says has grown 13% in two years – VW is now concentrating on delivering the best customer service it can.

“A chain is only as strong as its weakest link,” says zu Dhona.

The manufacturer is to return to the CV Show in April this year, in stark contrast to 2015 when it held a static unveiling of the T6 in Germany when the NEC event was taking place, and will use the occasion to rebuild bridges with operators and restore confidence.

“It’s a great opportunity to meet with the network and customers,” zu Dhona says.

Visitors to the VW stand will not be distracted by the unveiling of any major new products because both the new Crafter and Amarok will make their debuts five months later at the IAA Show in Hanover.

The Amarok will go on sale in the third quarter of 2016 followed by the Crafter, which will be an exclusive VW product, built at its new plant in Poland, following the termination of the agreement with Mercedes that saw previous generations of the large van based on the (Mercedes) Sprinter.

The CV Show will also come too early to host the reveal of the Sportline Transporter T6, which is set to arrive this summer.

But the Crafter is the model VW hopes will be the game changer.

Zu Dhona says: “It will enable us to compete in a sector we haven’t been able to address [in large volumes] with the current model.”

Dealer network tool

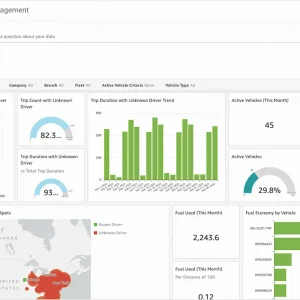

Volkswagen’s LCV network comprises 72 Van Centres and 24 authorised repairers. Each sales centre employs a Business Development Manager (BDM) who is tasked with developing relationships with sub-100 strong fleets. Since September 2015 BDMs at 20 Van Cenres have piloted an Ipad sales tool designed to enable them to answer the questions of well-informed customers.

“It’s the next step in the journey to the digital showroom of the future,” zu Dhona claims.

From the end of February VW is rolling the Ipads out across its network.

VW has identified the financial burden of van downtime, which it claims can cost up to £500 per vehicle per day, as customers’ main concern. To counter this it is offering extended opening hours at its sites, which open at least 11 hours a day. But rather than dictate the hours dealerships must open it allows them to take account of their customers’ and staff’s preferences.

The brand claims dealership employees appreciate the opportunity to work flexibly by offering “twilight” or overnight servicing.

Online service bookings and the ‘C it Now’ video facility to allow customers to watch their vans being worked upon, are other innovations VW has rolled out across its network in a bid to improve accessibility and trust.

Chris Black, Volkswagen’s head of fleet, says the brand took a decision several months ago to increase its presence in larger fleets – beyond the SMEs and local fleets where it traditionally thrives.

“We want to move further up the food chain to fleets of 100 to 300 vans,’ says Black.

He adds that VW has established five regional teams tasked with winning business from fleets of up to 750 vehicles.

VW Commercial Vehicles has gone through a traumatic period but seems to be weathering the storm. But, as Black explains, whereas the emphasis was historically on product, it now needs to shift equally to customer service.